Tax

Why Connecticut.20191017132937

Why Connecticut.

FMLOctober 17, 2019

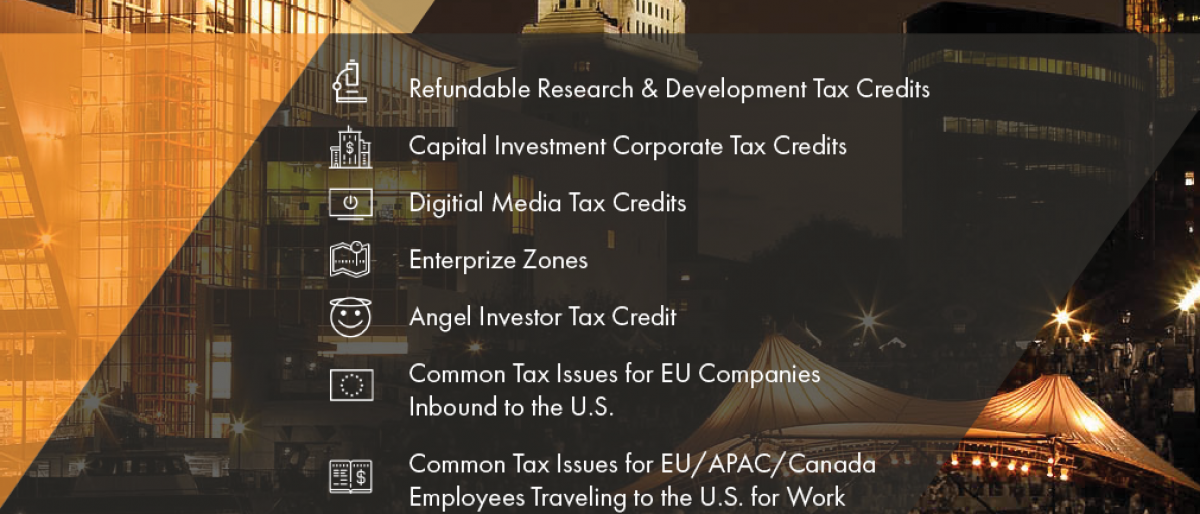

A brief overview of some of the numerous tax credits and incentives available to inbound companies seeking to do business in Connecticut, prepared specifically for the 2019 Venture Clash finalists by FML, proud sponsor of VentureClash....

FML’s Tax Checklist for C-Corporation Start-Ups20190909105732

FML’s Tax Checklist for C-Corporation Start-Ups

FMLSeptember 9, 2019

Your steps for setting up your start-up or emerging C-Corporation from FML's tax expert. Organizing, registering, getting an EID, necessary forms, more...

FML’s Tax Checklist for LLC Start-Ups with Two or More Owners20190820164128

FML’s Tax Checklist for LLC Start-Ups with Two or More Owners

FMLAugust 20, 2019

FML's complete tax checklist for LLC start-ups with two or more owners. Keep your finances in line for Uncle Sam with this comprehensive outline...

FML’s Tax Checklist for LLC Start-Ups20190813103746

FML’s Tax Checklist for LLC Start-Ups

FMLAugust 13, 2019

Your steps for setting up your start-up or emerging single-owner LLC from one of FML's tax experts. Organizing, registering, getting an EID, your first tax filing and more....

The New (2019) Tax on Parking Expenses20190213091324

The New (2019) Tax on Parking Expenses

FMLFebruary 13, 2019

Have you considered the impact of the new tax law on your not-for-profit organization? Many not-for-profit organizations are surprised to find that they now may be required to pay a federal tax. There is a new Internal Revenue Service Code Section (IRS Code) that may require tax-exempt organizations...

FML State and Local Tax (SALT) UPDATE20190116095615

FML State and Local Tax (SALT) UPDATE

FMLJanuary 16, 2019

The State of Connecticut’s Department of Revenue Services (DRS) has issued notices informing many taxpayers that their elections to re-characterize personal estimated tax payments as payments against the pass-through entity tax for 2018 have been rejected. The notice requests a response within 14 da...

Foreign “Crypto Exchange” Reporting (FBAR) Due 10/1520180925220033

Foreign “Crypto Exchange” Reporting (FBAR) Due 10/15

FMLSeptember 25, 2018

(Extended Automatically from April 15th) Many U.S. Crypto Asset investors and companies may be subject to an often overlooked reporting requirement imposed by the U.S. Financial Crimes Enforcement Network (FinCEN). In General – “FBAR” Form 114 United States citizens, residents and entities are requi...

Tax compliance after M&As20171201102228

Tax compliance after M&As

FMLDecember 1, 2017

Elections, carryovers, and debt offer plenty of issues to track following either a stock or an asset deal. Accounting for merger and acquisition (M&A) activity is a common challenge for tax compliance professionals. Since each transaction can result in unique tax issues, a one-size-fits-all appr...