Tax

Paycheck Protection Program Section 265: Alert20200503170447

Paycheck Protection Program Section 265: Alert

FMLMay 3, 2020

On April 30, 2020, the IRS issued Notice 2020-32 regarding the deductibility for Federal income tax purposes of certain otherwise deductible expenses incurred in a taxpayer’s trade or business when the taxpayer receives a loan (covered loan) pursuant to the Paycheck Protection Program and ...

Tax Deadline Expanded IRS Notice 2020-2320200410134124

Tax Deadline Expanded IRS Notice 2020-23

FMLApril 10, 2020

IRS Notice 2020-23 expands prior IRS Notices by extending tax filing and payment deadlines to July 15, 2020 for a much broader list of ‘specified forms’ and ‘specified payments’. The list is expansive but only includes the items/forms therein. We note that the extensions apply to b...

Individual Tax Considerations for the CARES Act – Alert20200330125518

Individual Tax Considerations for the CARES Act – Alert

FMLMarch 30, 2020

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief and Economic Security (CARES) Act, which provides relief to taxpayers affected by the novel coronavirus (COVID-19). The CARES Act is the third phase of federal government aid related to COVID-19. The CARES Act...

Business Tax Considerations for the CARES Act: Deep Dive20200330101800

Business Tax Considerations for the CARES Act: Deep Dive

FMLMarch 30, 2020

FML leadership shares insights that could affect how your business approaches this legislation On March 27, 2020, President Trump signed into law the $2 trillion bipartisan Coronavirus Aid, Relief, and Economic Security (CARES) Act (H.R. 748). The CARES Act includes many fe...

FML Promotes Justin Wilcox, CPA to Partner20200108081700

FML Promotes Justin Wilcox, CPA to Partner

FMLJanuary 8, 2020

Fiondella, Milone & LaSaracina (FML), Glastonbury-based accounting and advisory firm, announces the promotion of Justin Wilcox, CPA, to Partner. ...

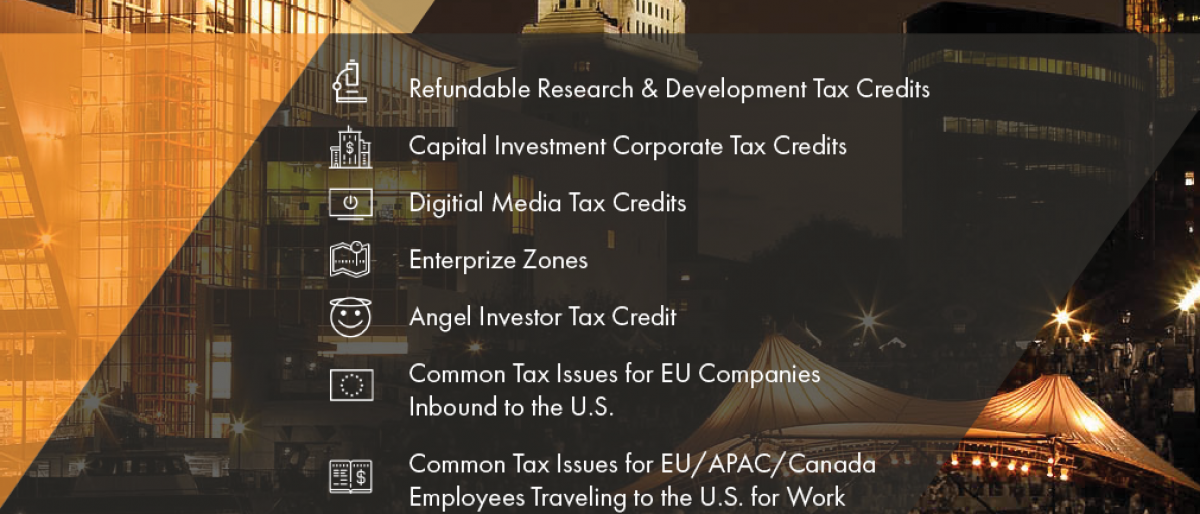

Why Connecticut.20191017132937

Why Connecticut.

FMLOctober 17, 2019

A brief overview of some of the numerous tax credits and incentives available to inbound companies seeking to do business in Connecticut, prepared specifically for the 2019 Venture Clash finalists by FML, proud sponsor of VentureClash....

FML’s Tax Checklist for C-Corporation Start-Ups20190909105732

FML’s Tax Checklist for C-Corporation Start-Ups

FMLSeptember 9, 2019

Your steps for setting up your start-up or emerging C-Corporation from FML's tax expert. Organizing, registering, getting an EID, necessary forms, more...

FML’s Tax Checklist for LLC Start-Ups with Two or More Owners20190820164128

FML’s Tax Checklist for LLC Start-Ups with Two or More Owners

FMLAugust 20, 2019

FML's complete tax checklist for LLC start-ups with two or more owners. Keep your finances in line for Uncle Sam with this comprehensive outline...

FML’s Tax Checklist for LLC Start-Ups20190813103746

FML’s Tax Checklist for LLC Start-Ups

FMLAugust 13, 2019

Your steps for setting up your start-up or emerging single-owner LLC from one of FML's tax experts. Organizing, registering, getting an EID, your first tax filing and more....

The New (2019) Tax on Parking Expenses20190213091324

The New (2019) Tax on Parking Expenses

FMLFebruary 13, 2019

Have you considered the impact of the new tax law on your not-for-profit organization? Many not-for-profit organizations are surprised to find that they now may be required to pay a federal tax. There is a new Internal Revenue Service Code Section (IRS Code) that may require tax-exempt organizations...